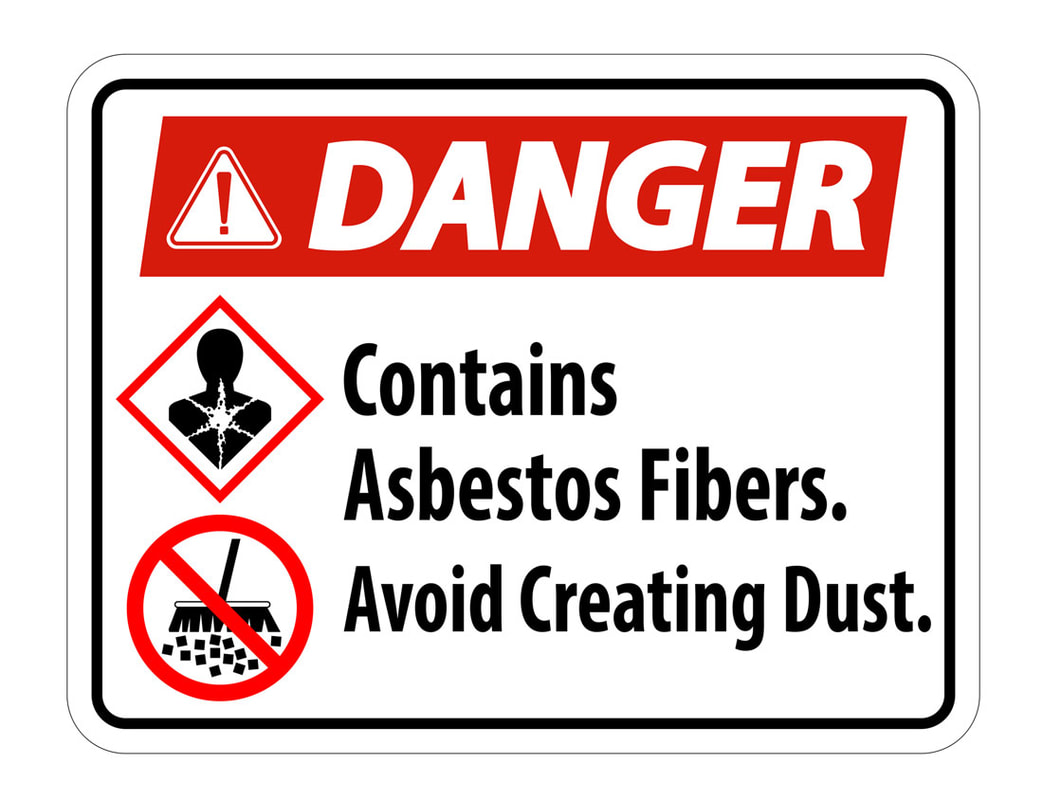

The authors of this guest essay, Evelyn Fletcher Davis and William T. Wood, III are partners in the Atlanta office of Hawkins Parnell & Young, LLP, where their practices focus on asbestos litigation defense. This three-part guest article examines the evolution of the bankruptcy trust system (Part I), how control over the trust system by plaintiffs’ counsel has resulted in unfair allocations of responsibility, double recoveries and excessive costs (Part II), and offers practical advice to defense counsel to fix the disconnect between the tort and trust systems (Part III).We live at a time when humanity is steadily moving away from riskier forms of self-sufficiency to safer and more productive forms of mutual interdependence. The COVID-19 pandemic is yet another test of humanity’s progress in building enterprise-wide approaches for managing risk. The question now is whether the post-pandemic era can serve as a hinge in history that sparks a repurposing and reframing in the field of Enterprise Risk Management.Lessons from the Pandemic Insurance Coverage Wars Part III: Mediation as a Tool for Risk Management4/29/2021 The COVID 19 pandemic has radically altered the insurance claims and underwriting environment and has resulted in more than 1,500 insurance coverage litigations. In the third of three essays on lessons for risk management professionals, Peter A. Halprin, our guest columnist and a Partner at Pasich LLP, discusses mediation as a risk mitigation tool for risk management professionals.The Ohio Supreme Court has agreed to answer certified questions of law on COVID-19 property damage. The answers to these questions will have a significant impact on coverage for COVID-19 losses.We live at a time when humanity is steadily moving away from riskier forms of self-sufficiency to safer and more productive forms of mutual interdependence. Consequently, the future of ERM will be concerned with building enterprise-wide approaches to pursuing opportunities and managing threats. Such approaches require that ERM adapt to becoming a process that combines rationality with reverence for life as a means of obtaining total engagement to better manage risk.The COVID 19 pandemic has radically altered the insurance claims and underwriting environment and has resulted in more than 1,500 insurance coverage litigations. In the second of three essays on lessons for risk management professionals, Peter A. Halprin, our guest columnist and a Partner at Pasich LLP, discusses the differing approaches taken by governments in relation to business interruption losses and coverage disputes.Bedivere Insurance Company has been placed into liquidation and a deadline of December 31, 2021 has been set as the deadline for policyholders to file a Proof of Claim.

We live at a time when humanity is steadily moving away from riskier forms of self-sufficiency to safer and more productive forms of mutual interdependence. Consequently, the future of ERM will be concerned with building enterprise-wide approaches to pursuing opportunities and managing threats. The future success of ERM, however, depends on whether it is grounded in an overarching philosophy and core purpose summed up best as reverence for life.Policyholders with Home Insurance Company policies should be aware that the court in the Liquidation of Home Insurance Company has entered an Order setting the claim amendment deadline.

|

AuthorsLori Siwik and Mark Siwik are the founders of SandRun Risk. They apply the principles of vertical leadership and lean six sigma to the discipline of risk management. From time to time they share their blog with guest authors who write about important risk management principles. Categories

All

Archives

March 2023

Categories

All

|

RSS Feed

RSS Feed