Future articles will explore in-depth the important internal and external areas of risk but going there now is premature. In our experience of working with middle market and large companies, business leaders often know some aspect of risk (financial, insurance, legal etc.) but struggle with discerning the overall risk patterns (whether opportunities or threats) from the mass of detail generated throughout different parts of the organization. Not being able to see the forest from the trees is the typical description used to describe this condition. Rather than getting lost in the forest (and there are many ways to do in risk management!), let’s step back and think about an organization (like a forest) as an ecosystem comprised of systems within systems. We will also save the discussion of “enterprise risk management” for another day.

In thinking about an institutional learning system, three concepts are important: culture, habit, and action (i.e., a specific behavior). It’s the action to habit to culture sequence and the interrelationship between each of these three components that are foundational to building institutional learning systems. A repeated action does not become a habit until there is at least four to six months of repetition and habit formation has a higher probability of success if the setting is stable and supportive of human development. Moreover, habits do not comprise a culture until a majority of the people within an organization have the same habits. There are no shortcuts and it is the repetition of this process that leads to the creation of institutional learning systems that become iconic (e.g., John Wooden’s basketball teams that win 10 national championships in 12 years; Toyota Production System etc.).

Some of the best work done to investigate and understand institutional learning systems has occurred at the Massachusetts Institute of Technology (MIT) through the efforts of Gordon Brown (dean of MIT’s engineering school from 1959 to 1968) and Jay Forrester (a leader at MIT’s business school from 1954 to 1989). The work of Brown and Forrester in the 1940’s and 1950’s on the speed, reliability and storage capacity of computers (making possible the future work of people like Bill Gates and Steve Jobs) led them to create the field of systems thinking. Peter Senge, a successor to the work of Brown and Forrester, made the emerging field of systems thinking accessible to the business community in his book: The Fifth Discipline: The Art and Practice of the Learning Organization (1990) which Harvard Business Review would later identify as one of the seminal business books of the 20th Century.

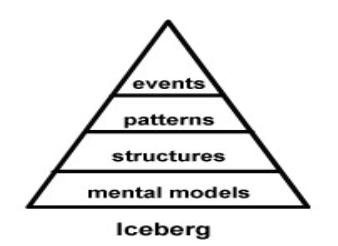

For purposes of risk management, we define systems thinking as a way of a developing an understanding of how the big picture (“the system or the forest”) operates and can be improved through the study of linkages and interactions between the components that comprise the entirety of the system. Among the most useful concepts from systems thinking is the iceberg model developed by anthropologist Edward T. Hall in the 1970’s. The iceberg model helps us see that culture is like an iceberg where all that is visible are the isolated events and outcomes that surprise and frustrate us. The first layer beneath the water are the behavioral patterns which produce the visible isolated events and outcomes. Underneath the behavioral patterns are systemic structures which are the relationships that yield and contribute to behavioral patterns. The bottom layer of the iceberg contains the mental models of people within an organization. A mental model is a habitual, ingrained way of thinking about how the world works.

True risk management operates at the bottom of the iceberg by affecting our deeply ingrained assumptions, images, and generalizations that influence how we think (mental models) and our interactions with others (systemic structures).

Our next article in this series will share the story Paul O’Neill, the former Alcoa CEO whom we were privileged to meet in July 2017, and how O’Neill helped his company create an institutional learning system designed to prevent workplace injuries. We also recommend that our readership explore our three-part interview of Don Dinero – a leading expert on one of the world’s best methodologies (Training Within Industry TWI) for creating an institutional learning system.

RSS Feed

RSS Feed