Our recent columns explored the risk management approach of Paul O’Neill and Stanley McChrystal and the architecture of institutional learning systems which are a form of distributive networks. What can the emerging science on human behavior in distributive networks teach us about the future of risk management?

- Bill Drayton, Interview with the Smithsonian, April 19, 2013

Our last few columns focused on how organizational models for risk management are shifting away from hierarchical systems to distributive networks that resemble a hive or communal mind. A hive or communal mind is a dense network of human intelligence that resembles a fishnet that allows a better flow of knowledge and information throughout the network than what is possible in a hierarchical system. The hive/communal mind or distributive network is what Paul O’Neill and Stanley McChrystal helped their organizations (Alcoa and Joint Special Operations Task Force) become.

What can science teach us about how to help more business leaders build distributive networks for managing risk. Better understanding human behavior and the flow of ideas between people started two centuries ago with Auguste Comte, the founder of sociology. Compte coined the term “social physics” after concluding that mathematical tools from various sciences (physics, statistics, biology etc.) could be used to analyze human interaction. In our view, some of the best work in the field of “social physics” has occurred in the last 20 years at the M.I.T. Media Lab which is led by Alex Pentland.

Pentland’s career focus began in the 1970s when he was a student at the University of Michigan. While there, Pentland worked on a project that studied Canada’s beaver population by tracking the animal’s movements throughout the country. That project helped spark ideas for Pentland’s current work. Instead of analyzing animal behavior, Pentland and his graduate students attach sensors to people to study their patterns of communication and movement in work settings. With the invention of the cellphone, the most ubiquitous sensor available, social physics now operates in the world of big data which brings an ability to measure the flow of ideas and knowledge through mathematical analysis of communication and transactions.

Pentland’s research proves that the best environments for risk-related decision-making are distributive networks that exhibit high levels of both engagement and exploration. Engagement is a measure of social learning – that is, how often people in a group communicate with each other. High engagement leads to faster development of behavioral norms and increased social pressure to enforce those norms. Exploration measures the frequency by which people seek out new potentially valuable ideas by building and mining various parts of the distributive network or diverse social networks.

Pentland’s research is summarized in his book entitled Social Physics, How Good Ideas Spread – The Lessons from a New Science (2014). At bottom, the objective of social physics is to improve the process for pooling ideas in a way that feeds back the best current idea for implementation or what we sometimes call “wisdom of the crowd.” A key component to the “wisdom of the crowd” approach to risk management is making sure that there is sufficient diversity in the crowd to allow knowledge to surface from unexpected places.

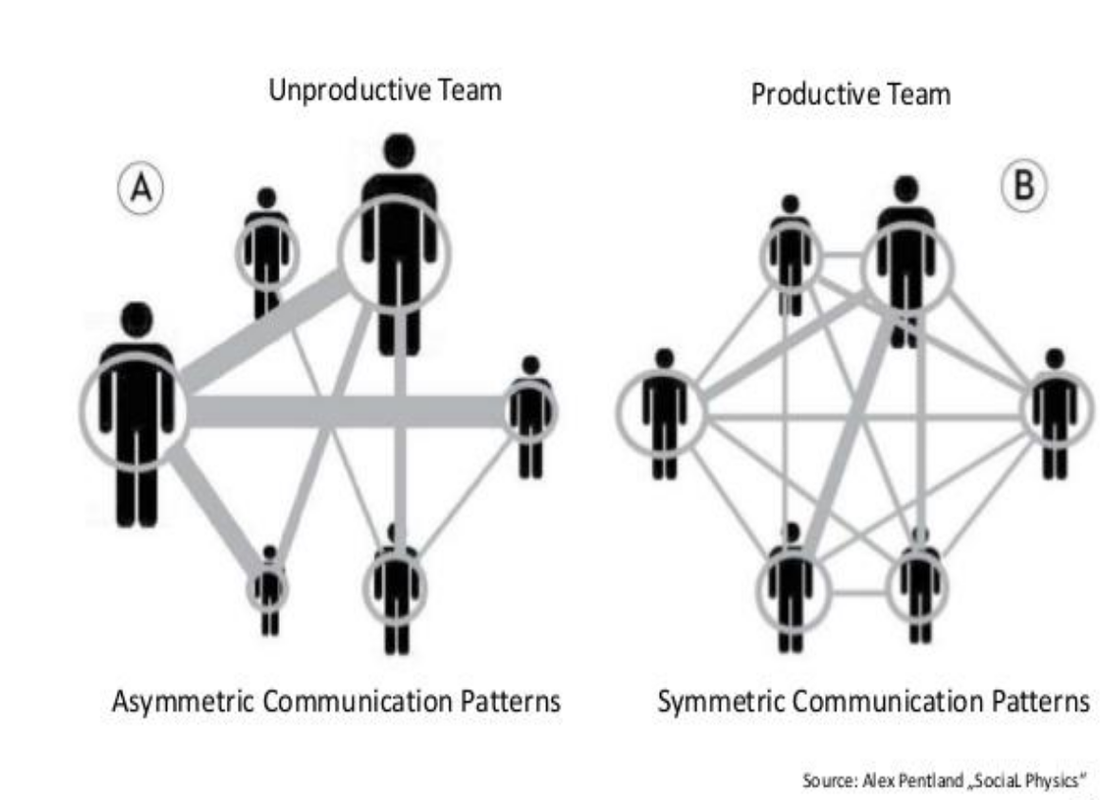

Pentland’s thesis is illustrated in the diagram below which depicts the typical traditional model of risk management on the left and the emerging model of risk management on the right.

In sum, the pattern of idea flow within an organization is perhaps the single biggest factor to determining whether an organization will resemble a distributive network that ensures the organization will “learn to thrive” – the goal of risk management. Our next column focuses on the emerging science supporting a leadership approach that is so critical to building distributive networks.

RSS Feed

RSS Feed