This article series addresses the concept of risk – a seemingly simple word that confounds most organizations when it comes to strategy and tactics. What is risk? Getting to a clear and consistently understood definition of risk is a fundamental of good business leadership.

-Buckminster Fuller, 20th Century Visionary and Inventor, Presidential Medal of Freedom Winner

Our first article series entitled “A Risk Management Primer for Business Leaders” taught that risk management is the science of building and maintaining an interdisciplinary framework for learning to thrive in uncertainty. In that article series, we focused on the phrase “learning to thrive” – explaining that the greatest risk facing middle market and large companies is the development of business leaders who can put a human face on risk management and help grow a workforce that is constantly learning, improving and adapting to ever-changing conditions. We introduced the concept of corporate longevity as a key metric, demonstrated the need for business leaders to become “chief learners” that serve within an institutional learning system, and illustrated how an institutional learning system is essential to effective risk management.

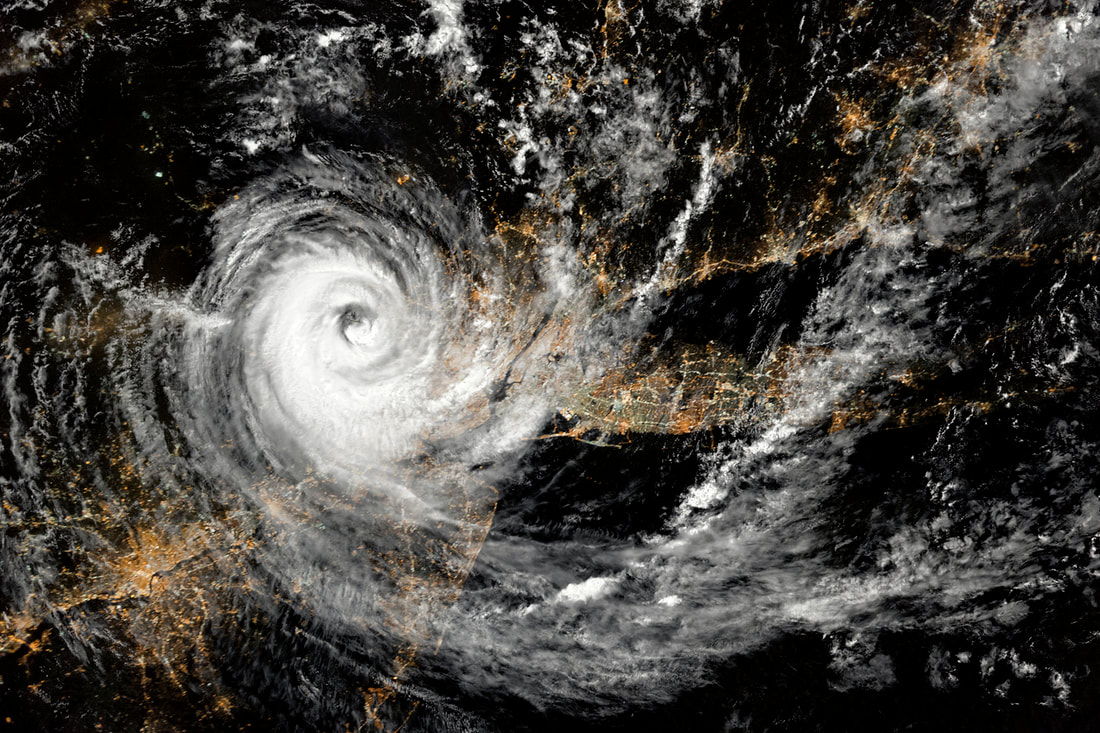

Using the examples of Paul O’Neill at Alcoa and Stanley McChrystal at the Joint Special Operations Task Force, we described how learning to thrive occurs when companies build organizational models of emergent intelligence and awareness that enable greater adaptability to changing circumstances. The type of distributive network of human intelligence developed by O’Neill and McChrystal optimize risk-taking through peer-to-peer interactions that (i) yield an increased number of ideas; (ii) facilitate dense interaction to evaluate ideas and build consensus regarding a desired course of action, and (iii) promote diversity to enable ideas to come from unexpected places. Thomas Friedman described this approach to risk management as akin to operating within the eye of a hurricane that moves with the storm, draws energy from it, and creates a platform of dynamic stability within it – “a healthy community where people can feel connected, protected, and respected.” (T. Friedman, Thank You for Being Late – An Optimist’s Guide to Thriving in the Age of Accelerations (2016).

The idea of performing well in the midst of a hurricane is a helpful transition to this article series which focuses on what business leaders should know and understand about risk. We start by returning to our definition of risk management - an interdisciplinary framework for learning to thrive in a state of uncertainty. Our focus shifts now to the end of the definition – the concept of uncertainty.

Naturally, our capacity to learn and thrive is limited by our inability to ever fully know or control ourselves and the world we live in. If learning to thrive is one side of the coin, uncertainty is the opposite side. Our internal frailties and the external environment make it impossible to live and work in such a way that only good things happen (positive risk) and that bad things (negative risk) never happen. No matter what we do, uncertainty and unpredictability are a part of everyday life.

Our human discomfort with uncertainty has led to many important advancements, including the creation of a number of disciplines to manage uncertainty. Current organizational models in middle market and large companies divide responsibility and expertise for addressing uncertainty along five broad categories: (i) board and chief executive, (ii) finance and treasury, (iii) legal/compliance, (iv) risk specialists such as managers for the environment, health, safety, insurance procurement, claims administration, and workers’ compensation, and (v) operations (my favorite area!). Externally, companies encounter uncertainty across five categories: (i) customers/public, (ii) suppliers, including but not limited to insurance brokers and insurers (a very small percentage of suppliers), (iii) government/regulations, (iv) financial institutions/banks, and (v) media – traditional and social. How these categories of internal and external areas of focus fit together in a “learn to thrive” model will be addressed later when we explore how best to build an interdisciplinary framework for learning to thrive in a state of uncertainty.

For now, let’s learn everything we can about uncertainty. Why use the word uncertainty instead of risk? Pick up any good book on risk management and you are likely to see a call to redefine, rethink or even abandon the word risk. For example, Dan Borge, former partner and managing director at Bankers Trust and author of The Book of Risk believes:

- The term “risk management” is loaded with connotations of caution and timidity, carrying unpleasant reminders of dreary sessions with insurance agents and infuriating lectures from parents on the danger of having a good time. People who think about risk management at all are likely to think of it as a grim necessity, at best. (Dan Borge, The Book of Risk at 3 (2001).

So, let’s change the paradigm by replacing the word risk with uncertainty. Uncertainty is a broader and more inclusive concept than risk which too often is focused on what can be measured and what can be done to control or prevent the downside. Uncertainty allows for the possibility that not all can be measured, quantified, or managed. Uncertainty permits an examination of the past and the future. It is way to see the upside as much as the downside. In short, uncertainty meshes better with the concept of learning and thriving. Too often, a risk-based focus produces fear, blame, and restraint.

That is not a fun way to live and it’s an ineffective way of ensuring that anything done in the name of risk management is creating or adding value to the organization. Over the next few articles, we will explore the concept of uncertainty.

RSS Feed

RSS Feed