Risk is a seemingly simple word that confounds most organizations when it comes to achieving strategic outcomes. We prefer the word uncertainty. Uncertainty includes maximizing strengths, not just minimizing weaknesses. Appreciating our strengths helps increase the probability and magnitude of good things happening or what we call positive risk.

Grasp opportunities

Convert threats

Enjoy uncertainty!

- Felix Kloman - Past Winner of the Goodell Award,

the Most Prestigious Award bestowed by the Risk and Insurance

Management Society for Outstanding Achievement in the Field of Risk Management

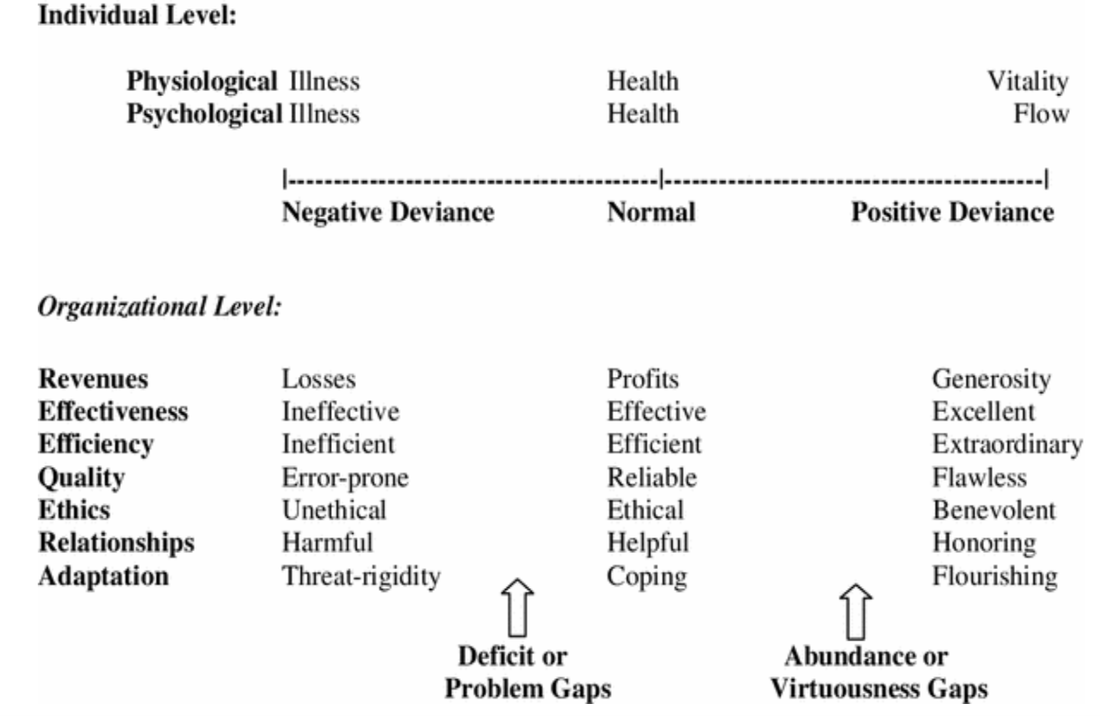

If we limit our view of uncertainty to the study of problems, we ignore two important concepts. First, everything is done by and through people which means that we should think of an organization as a living being that is the sum of the skills, capabilities and knowledge of the people that comprise the organization. Second, biology is the appropriate science for the study of life and living things. Accordingly, the study of uncertainty should be equally life-centered. If we only study problems or deficits, we miss the other half of the continuum which promotes the best of the human condition. Problem-centered approaches focus on getting back to normal while a life-centered approach focuses on amplifying strengths. Instead of moving from a negative to a zero, the emphasis is how to move from a “+1” to a “+10” or even a “+ 100.” The chart below summarizes the two ways to view uncertainty. Are we concerned only about eliminating deficit gaps that cause negative deviance or should we be equally concerned about increasing abundance and positive deviance?

Since the 1980s, David Cooperrider and Ronald Fry, two professors of organizational behavior at the Weatherhead School of Management at Case Western Reserve University (CWRU), have studied positive deviance as a method of change management in organization development. Their work started as a project with the Cleveland Clinic, arguably the number-one heart hospital in the world, at a time when the physicians were asking for more input in the hospital’s decision-making processes. In the beginning, the research followed a conventional model of conducting interviews of physicians designed to identify personal and organizational deficits and performance gaps. In fact, one of the core questions was “tell us your biggest failure.” The research team became demoralized when the physicians exhibited high levels of negativity and hostility toward the hospital and the researchers themselves. Seeing how stressed and demoralized the research team had become led to a breakthrough insight on the part of Suresh Srviastva, the chair of CWRU’s department of Organizational Behavior. Srviastva said: “I wonder if what is happening right now is a consequence of the questions we are asking.”

Srviastva’s observation changed history. Sensing an “aha” moment, the research team redesigned the leadership study to move away from the deficit-based questions to an inquiry into the best practices at the Cleveland Clinic. The questions shifted to eliciting information about was giving life to the hospital system and when it was most alive. The end result was a report that presented data which described operating practices of the hospital at their best and a depiction of an ideal-type future – what the whole organization could be like all the time. Dr. William Kiser, the hospital’s board chair, responded enthusiastically that the research team had “been able to peer into our soul.” (Inquiring Into Appreciative Inquiry: A Conversation with David Cooperrider and Ronald Fry, Journal of Management Inquiry (2017)).

Our next column will further explore the methodology created by Cooperrider and Fry to enable organizations to increase positive deviance or what the risk management community would call positive risk – increasing the probability and magnitude of good things happening. Embracing and facilitating positive risk is at the heart of successful leadership. As Peter Drucker said: “the ageless essence of leadership is to create an alignment of strengths in ways that make systems’ weaknesses irrelevant.”

RSS Feed

RSS Feed