Risk is a seemingly simple word that confounds most organizations when it comes to achieving strategic outcomes. We prefer the word uncertainty. Increasingly, the role of business leaders will be to help others in their organizations learn how to frame, evaluate and communicate uncertainty – especially the type of uncertainty that is complicated or complex.

- Rick Nason, Rethinking Risk Management, Critically Examining Old Ideas and New Concepts (2017)

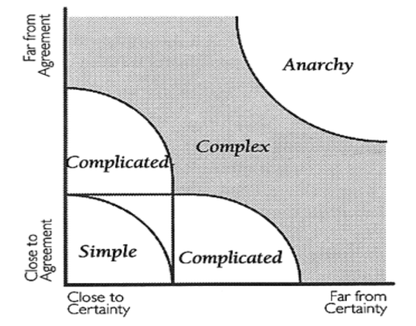

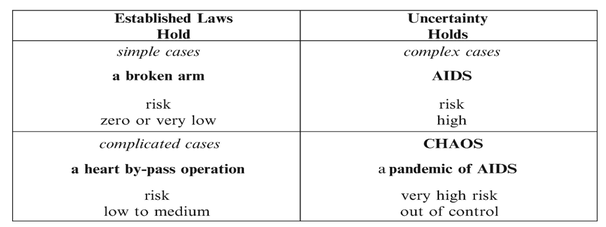

The previous section introduced the Stacey matrix (depicted below) as a way to think about risk and uncertainty. In a perfect world, stability, predictability, and consensus would be the norm such that every business problem would be resolved in simple and straightforward manner. With simple risk and complicated risk, linear analysis (event A causes effect B) and rational decision-making is the norm. In contrast, Stacey’s matrix helps us see that businesses also operate in a state of complexity - a dynamic, fast paced environment where a different set of skills and alternative decision-making processes is needed.

Since the Industrial Revolution, business leaders have largely focused on complicated risk. Led by the scientist and engineer Frederick Taylor whose thinking would be adopted by global companies (Toyota, Ford and many others), the objective has been to define, measure and improve production. Efficiency experts devise a solution and launch it, believing that the solution is whole, complete, actionable, and replicable. Efficiency also works best with risks that are known, obvious and actionable. Consequently, traditional risk management consists of a three-step approach to address uncertainty: identify the risk (predict/forecast); quantify the risk (assess/measure); and control the risk (plan/treat/mitigate).

This approach to complicated risk has worked reasonably well. Think back to the 20th century when the engineering skill used to design machines (steam engines, trains, tractors and automobiles) replaced muscles and animals as the dominant factors of production. Naturally, the role of the human as a doer shifted to one of manager. Muscle became a commodity that was less valuable than the knowledge and skill (think engineering) to engage in complicated thinking.

The work landscape is changing once again. The skill to engage in complicated thinking is now becoming commoditized in a hyper-connected world that is changing both people and the environment. The rise of personalized technology means a global system of nearly eight billion human touch points that can interact locally, nationally, and globally. No longer is it safe to assume that employees, managers, and business leaders come from the same setting or that they resemble each other.

Global inner-connectivity is also changing the environment. No longer can we say that one solution that works in a given setting is guaranteed to work for another. This makes matters of risk management and corporate governance complex rather than complicated because solutions are not necessarily replicable and transferable.

Going forward, business leaders will need to understand and be skilled at both complicated thinking and complex thinking. In fact, one could argue that there is a skill progression in learning how to handle different types of uncertainty as envisioned below:

We believe that a sensible approach is to start with traditional risk management – a world dominated by insurance driven solutions – before tackling the more abstract levels of managing complexity. We also believe that risk intelligence (i.e., how to live and thrive in uncertainty) is both individual and collective. The next few sections will further explore uncertainty from the individual perspective.

RSS Feed

RSS Feed