This is the first article, in a three-part series of articles, that discusses the Standards Australia/Standards New Zealand Risk Management Handbook on Risk Financing Guidelines. This article discusses the role of risk financing and how a risk assessment can assist in evaluating the risk financing methods that can be used to treat an organization’s risks.

The third and final article of the series will discuss effective risk financing programs and the practical guidance of such programs as set forth in the Standards Handbook.

Let’s get started and discuss the role risk financing plays in an organization.

The Risk Financing Risk Management Assessment Process

Risk financing refers to preparatory measures undertaken to ensure the availability of funds after the occurrence of an unintended event. Risk financing may reduce the effect of the unintended event on an organization, thereby reducing the risk, or create new opportunities for the organization.

The costs associated with the various risk financing methods vary. An increase in cost of one risk financing method can serve as a stimulus for the development of other risk financing methods. Whatever risk financing method (or methods) is selected, it is important that the method(s) chosen ensure funds will be available when needed. Unfortunately, many organizations will only look at the transactional cost of the method selected. This shortsightedness can have serious consequences.

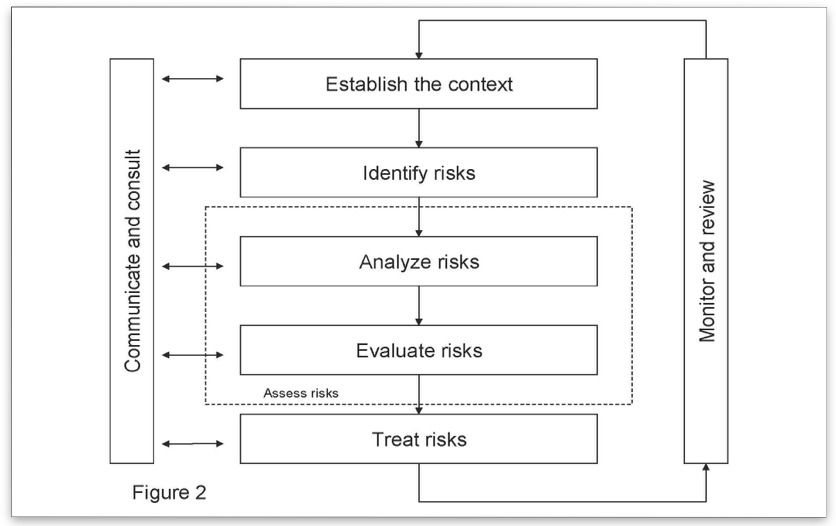

Effective risk financing arrangements require that the organization’s risks be accurately assessed and that the risk financing methods be evaluated in light of the risks. The following chart demonstrates the risk financing assessment process that an organization should undertake:

To Establish the Context, organizations will need to decide how much loss they can tolerate without external risk financing. Thus, to establish the context, the risk criteria need to be carefully evaluated, taking into account the organization’s financial stability and willingness to tolerate deviations from its goals.

Identify and Analyze the Risks is when organizations identify the risks (loss exposures). This includes direct losses, indirect losses, key personnel, and operations. These loss exposures can be identified through balance sheets, income statements and other records, compliance reviews, inspections, flow charts, questionnaires, and expertise within and beyond the organization. The objective is to clearly identify the possible losses a company faces. Analyzing the risks (loss exposures) is undertaken by estimating the likely significance of losses previously identified, and determining the loss frequency, loss severity, total dollar losses and timing of the losses. From these estimations, loss projections can be developed, and loss exposures prioritized.

Identifying and analyzing the Risks results in a risk analysis that sets forth the maximum loss that is foreseeable from any unintended event and its likelihood). A Risk Evaluation takes the risk analysis and compares it with the risk criteria, taking into account all types of events that can cause deviations. With this information the organization can develop a strategy to control the losses by examining loss-exposures and risk-control techniques to minimize the frequency or severity of losses and examining risk-financing techniques that generate funds to finance losses that risk-control techniques cannot entirely prevent.

Monitoring and review are important as the financial security of insurers or other sources of risk financing can change. Similarly, catastrophic losses elsewhere in the world can render a previously insurable risk uninsurable. Thus, organizations should monitor and review their risk financing arrangements on an annual basis. If an organization is using insurance as a risk financing tool, an annual meeting with the organization’s insurance broker is in order.

Conclusion

Organizations need to take an “eyes-wide-open” approach to identifying and understanding the risks they face so that they are managed properly to minimize impact on the organization’s performance.

Part two of the series will discuss several risk financing methods organizations can consider once they have undertaken the risk management assessment process.

RSS Feed

RSS Feed