Ian Pelham, Senior Vice President of InSolutions Ltd, England, explains that many UK companies are facing legacy employers’ liability claims. The problem with these legacy claims for diversified companies, especially those that have grown by mergers, is that they really have a definitive schedule of all companies within the group.

Ian Pelham is Senior Vice President of InSolutions Ltd, England.

Ian Pelham is Senior Vice President of InSolutions Ltd, England. A professional insurance archaeologist will tend to proceed with research under the following phases:

- Corporate history.

- History of products and services.

- Establishing insurer history.

To understand their future liabilities a company needs to understand its exact corporate, shareholder and trading history, their past trading practices, locations and any liabilities incurred through TUPE transfer of staff − The Transfer of Undertakings (Protection of Employment) Regulations (TUPE).

Employers liability insurance

After the formation in 1948 of the National Health Service workers' compensation administration (WCA) insurance was widely replaced with employers liability Insurance (EL). In 1969 the UK government passed the Employers' Liability (Compulsory Insurance) Act 1969 making the purchase of employers liability insurance compulsory from the January 1, 1972 in the UK other than Northern Ireland, which came into force January 1, 1974.

Financial Services Compensation Scheme (FSCS)

As a result of employers’ liability insurance being a compulsory cover from January 1, 1972 in the UK (January 1, 1974 Northern Ireland – as above), if an insurer fails then any periods that can be provided to be covered after January 1, 1972 (or January 1, 1974 Northern Ireland) the failed insurer are reimbursed under the compensation scheme. The FSCS is funded by a levy on UK insurers and if required will make cash calls on carriers.

Long tail claims drivers in the UK

- Asbestos-related diseases.

- Noise-induced hearing loss.

- Vibration white finger/ hand-arm vibration syndrome (HAVS).

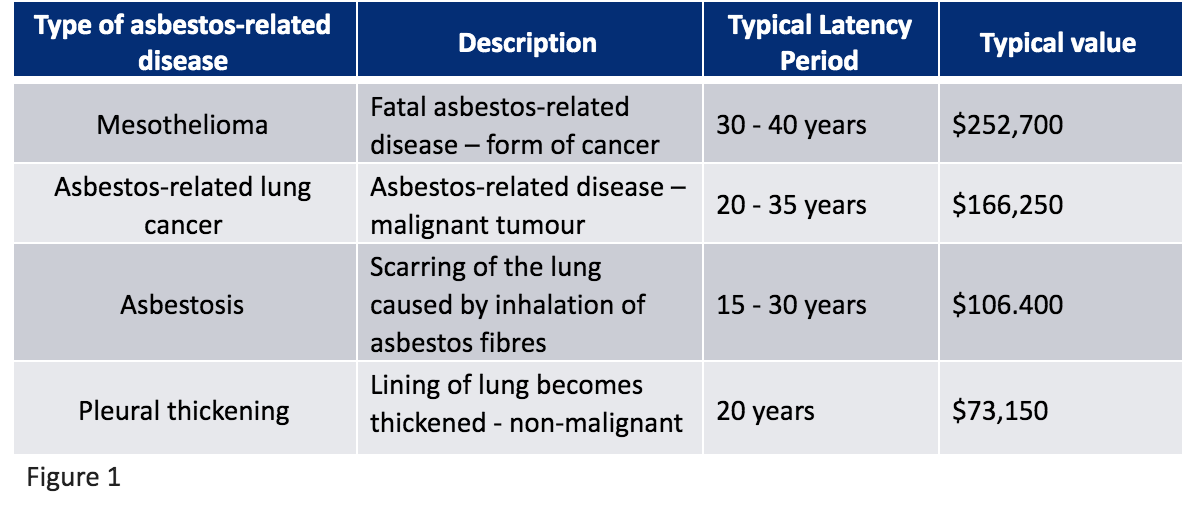

The two main drivers for legacy UK EL claims are asbestos and noise-induced hearing loss. Figure 1 below is a table showing the typical UK costs for asbestos:

Mesothelioma and the FSCS

Under the revised rules, a mesothelioma claim can be considered as qualifying for 100% protection where a proportion of the exposure is from 1972 onwards and where other sources of negligent exposure to asbestos can be identified — regardless of whether those sources were named as a defendant in any action. The FSCS will apply its revised stance retrospectively and will reimburse policyholders for any claim that meets the criteria where the policyholder has funded pre-1972 exposure since May 20, 2015. This only relates to mesothelioma claims; it is not applicable to other asbestos-related disease claims or other occupational disease claims.

The revised stance is positive for companies that have both exposure to insolvent insurers and mesothelioma claims. Some companies will be due substantial reimbursements. The most prominent insolvent insurer with disease liabilities is Chester Street Insurance Holdings (formerly Iron Trades Insurance Holdings). However, there are other insolvent insurers with historic disease claims where exposure periods straddle 1 January 1972, such as Builders Accident Insurance.

If a company had a mesothelioma claim where part of the exposure period was prior to 1972, they will have funded damages and third-party costs for the pre-1972 period on a pro-rata basis. The average value of a mesothelioma claims is approximately $252,700, with some exceeding $330,000 and, on occasion, exceeding $1.3 million. A company only needs to have funded payments for one such claim since 20 May 2015 to potentially be eligible for a substantial reimbursement. Companies should assess whether they have both exposure to insolvent insurers and mesothelioma claims and determine whether they are due reimbursements. Such an exercise should include:

- Establishing whether any claims meet the revised criteria.

- Identifying which of those claims have been open since May 2015.

- Quantifying the maximum recovery.

- Ensuring that the recovery amount is paid to policyholders as swiftly as possible.

UK domestic research

The first port of call for employers liability insurance is the Employers Liability Tracing Office (ELTO). ELTO is an independent body established by the Association of British Insurers (ABI) to manage a database of historic employers liability policies. The data that is being collected includes:

- All new and renewal employer’s liability policies since circa 1999.

- Lapsed policies that have had claims made against them since 1999.

- Any policies with outstanding claims as at 1 April 2011.

- Data previously provided via the ABI scheme.

- Many insurers have back logged the historic EL data they are aware of on the database.

If ELTO fails, which it often does, then three entities will have had details of the policy:

- Insured.

- Broker.

- Insurer.

An insurance archaeologist’s approach

In the UK each company that is limited by share must register with Companies House. This allows a researcher to establish a corporate tree. Often our first port of call is the Companies House to identify the company history and review the claims papers. Once we have established the historic names, we can conduct our review, which as well as ELTO will include:

- The clients own records.

- Brokers.

- Insurers.

The majority of EL insurance in the UK is written by the company market and is placed in the same way as US domestic covers. The only difference is when a Lloyd’s syndicate is used to underwrite the EL cover then one must rely on the Lloyd’s broker. The skills an archaeologist uses with the London market are the same as used by experienced UK domestic archaeologist. They will know for example if the risk was a motor dealership that only certain markets in the 1970s and 1980s would write such business and tailor their search accordingly.

What does this all mean?

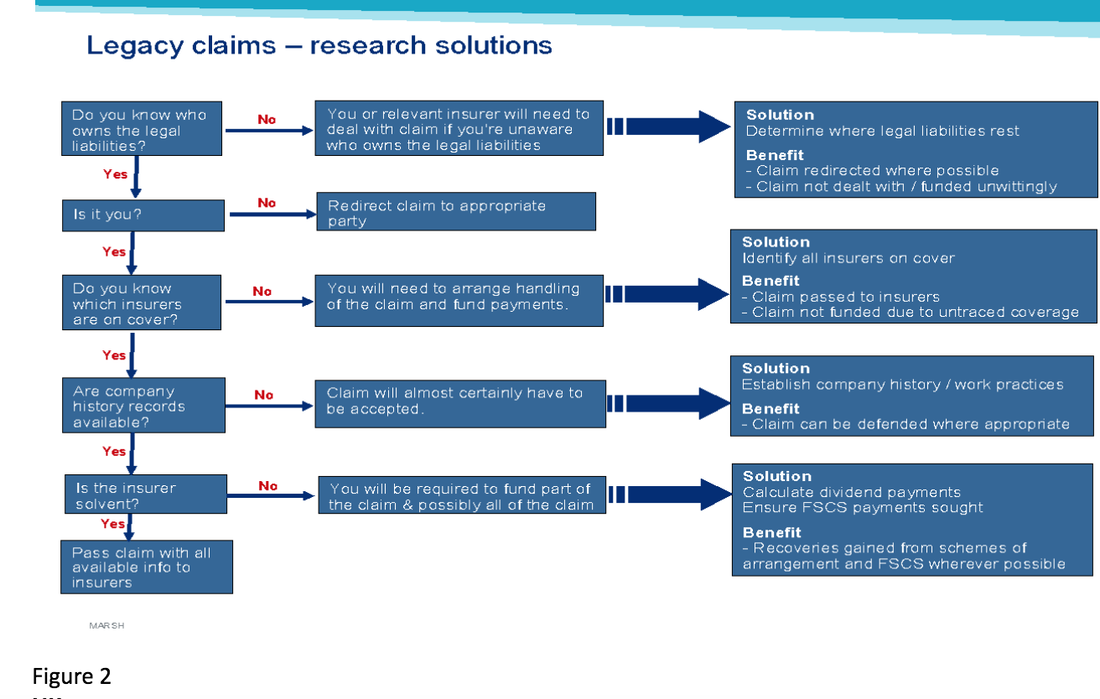

Clients should ensure that they review and understand their corporate histories and they should catalogue their old employers and public liability policies. In the UK clients should also close dormant companies within their group to avoid unnecessary claims. The following flowchart outlines matters to consider.

If a company becomes aware of a potential gap in its insurance records, we would advise them to investigate whether the insurers can be located for that period before they receive a claim. An archaeology review can often take several months and relies on many different record holders.

Also, if a company is considering purchasing an UK entity, they should ensure that they receive a full insurance history back to circa 1970 from the vendor.

Conclusion

The UK with our common law approach to liability and long connection to North America through the London market has and will continue to play a key role in legacy claims. Companies and their representatives must remember that thought there is a shared history the approach is subtly different in the UK. We would recommend companies should be mindful of these pitfalls and obtain professional local advice.

This is a marketing communication. The information contained herein is based on sources we believe reliable and should be understood to be general risk management and insurance information only. The information is not intended to be taken as advice with respect to any individual situation and cannot be relied upon as such. Statements concerning legal, tax or accounting matters should be understood to be general observations based solely on our experience as insurance brokers and risk consultants and should not be relied upon as legal, tax or accounting advice, which we are not authorized to provide.

In the United Kingdom, Marsh Ltd is authorized and regulated by the Financial Conduct Authority.

Copyright © 2018 Marsh Ltd All rights reserved

RSS Feed

RSS Feed