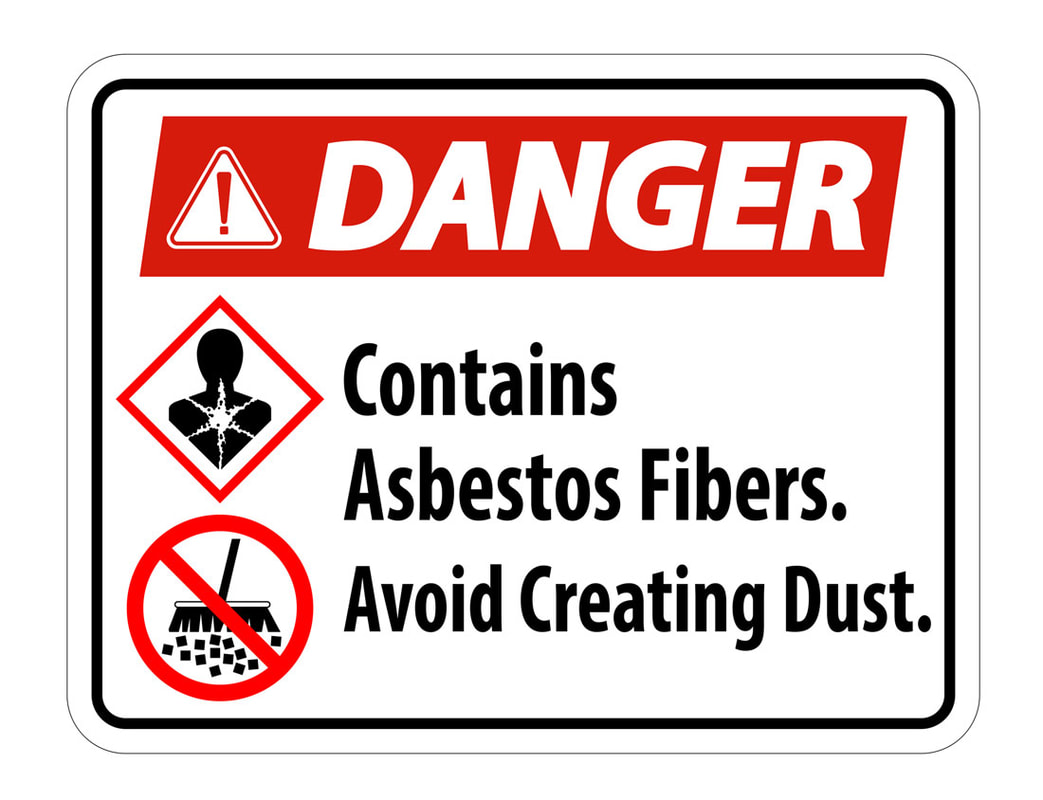

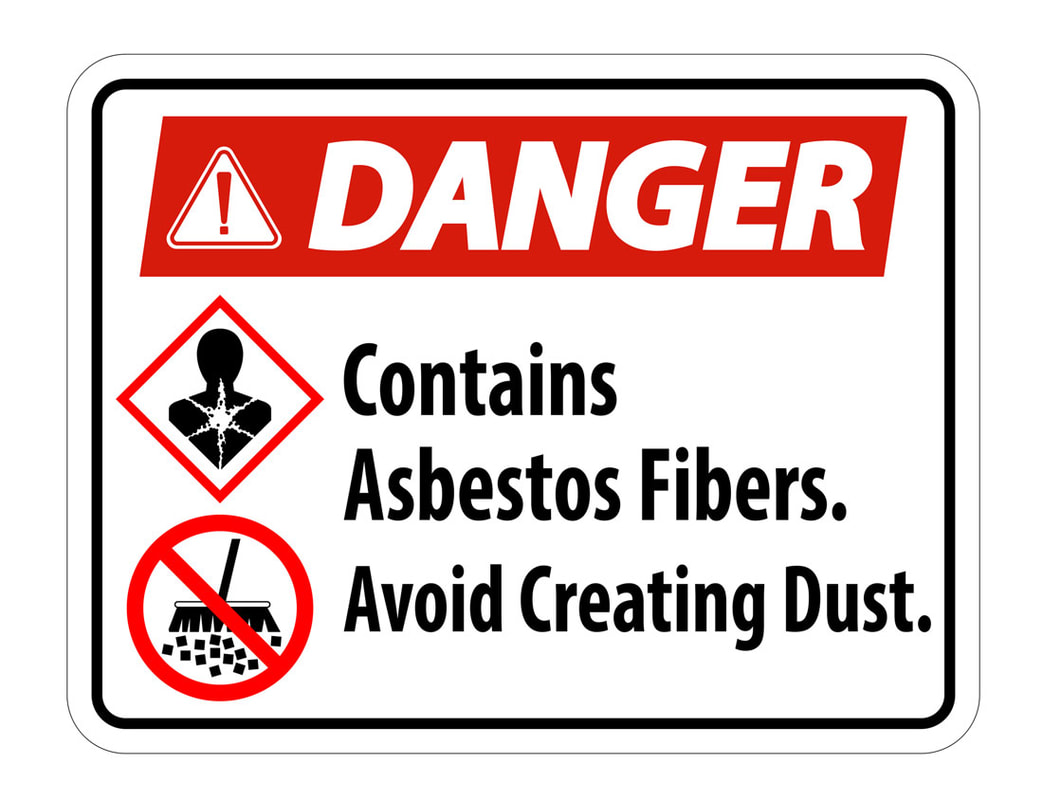

This is the first of three discussions with Roger Estall who is a role model for all those who aspire to a leadership role in risk management. Part I focuses on Roger’s extraordinary background and experience from working more than 40 years with a wide range of organizations on how to make decisions, manage uncertainty, and solve problemsWe live at a time when humanity is steadily moving away from riskier forms of self-sufficiency to safer and more productive forms of mutual interdependence. This happens only through the evolution of existing systems and models for managing uncertainty. The COVID-19 pandemic can be a turning point that leads to a step-change in the effectiveness of ERM.This is the second article, in a three-article series, that discusses the risk financing guidelines set forth in the Standards Australia/Standard New Zealand Committee OB-007, Risk Management Handbook (“Standards Handbook”). This second article focuses on the various risk financing methods set forth in the Standards Handbook.This is the first article, in a three-part series of articles, that discusses the Standards Australia/Standards New Zealand Risk Management Handbook on Risk Financing Guidelines. This article discusses the role of risk financing and how a risk assessment can assist in evaluating the risk financing methods that can be used to treat an organization’s risks.We live at a time when humanity is steadily moving away from riskier forms of self-sufficiency to safer and more productive forms of mutual interdependence. The COVID-19 pandemic is yet another test of humanity’s progress in building enterprise-wide approaches for managing risk. In this section, we look at our progress in shaping communication that fosters total engagement.The authors of this guest essay, Evelyn Fletcher Davis and William T. Wood, III are partners in the Atlanta office of Hawkins Parnell & Young, LLP, where their practices focus on asbestos litigation defense. This three-part guest article examines the evolution of the bankruptcy trust system (Part I), how control over the trust system by plaintiffs’ counsel has resulted in unfair allocations of responsibility, double recoveries and excessive costs (Part II), and offers practical advice to defense counsel to fix the disconnect between the tort and trust systems (Part III).For those insurance policies issued for more than one year, policyholders often argue that the insurance policies provide for annual aggregate limits. Two court decisions in Ohio agreed with the policyholder.The authors of this guest essay, Evelyn Fletcher Davis and William T. Wood, III are partners in the Atlanta office of Hawkins Parnell & Young, LLP, where their practices focus on asbestos litigation defense. This three-part guest article examines the evolution of the bankruptcy trust system (Part I), how control over the trust system by plaintiffs’ counsel has resulted in unfair allocations of responsibility, double recoveries and excessive costs (Part II), and offers practical advice to defense counsel to fix the disconnect between the tort and trust systems (Part III).Improving ERM Practices in the Age of Pandemics and Cyber Crime: Part XII - It Starts With Education7/5/2021 We live at a time when humanity is steadily moving away from riskier forms of self-sufficiency to safer and more productive forms of mutual interdependence. This happens only through the evolution of existing systems and models for managing uncertainty. The COVID-19 pandemic is a powerful reminder that improving the rate of learning in a community is essential for evolution to occur. |

AuthorsLori Siwik and Mark Siwik are the founders of SandRun Risk. They apply the principles of vertical leadership and lean six sigma to the discipline of risk management. From time to time they share their blog with guest authors who write about important risk management principles. Categories

All

Archives

March 2023

Categories

All

|

RSS Feed

RSS Feed